FY2024 Budget

The Board of County Supervisors (BOCS) adopted the FY2024 Budget on April 25, 2023, and is available in its entirety or by sections below. This is the County's adopted budget beginning July 1, 2023, through June 30, 2024.

Understanding the Budget

The following sections of the FY2024 Budget aids in understanding the budget development process and explains the County's various revenue sources and expenditure budget. It also informs the community of capital infrastructure improvements as well historical and statistical trends in the County.

- Introduction

- Budget Development Process

- Budget Summary

- Revenues

- Expenditures

- Compensation

- Agency Page Information

- Community Partners

- Capital Improvement Program

- Appendix

The Budget

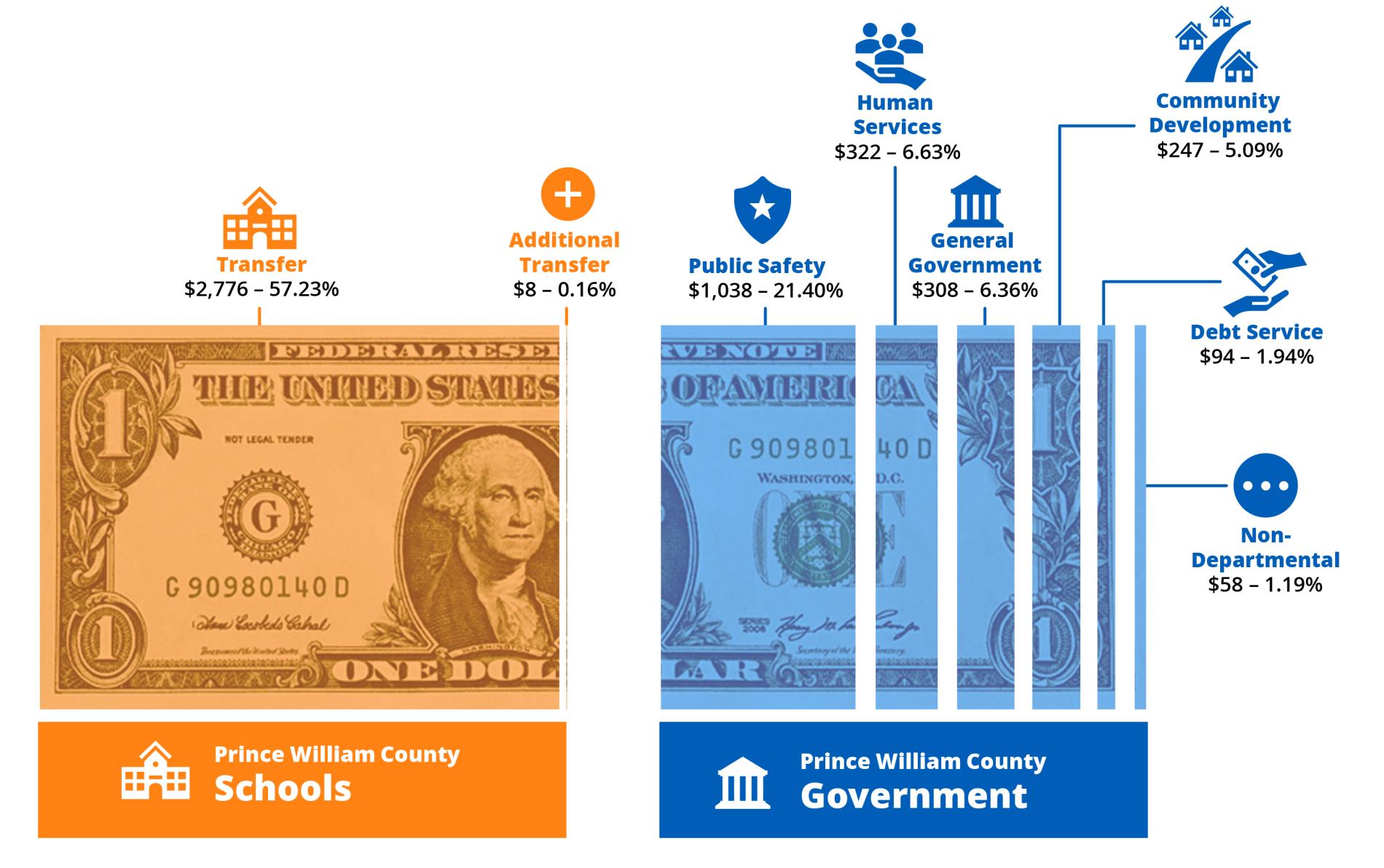

The FY2024 Budget is funded at a real estate tax rate of $0.966 per $100 of assessed value. The average residential tax bill based on that tax rate is $4,850. The following infographic shows the services that the average tax bill funds by functional areas. Information about the budget is available in sections below.

Community Development accounts for $247 and 5.09% of the average residential tax bill in FY24.

- Development Services

- Economic Development

- Library

- Parks, Recreation & Tourism

- Planning

- Public Works

- Transit Subsidy

- Transportation

General Government accounts for $308 and 6.36% of the average residential tax bill in FY24.

- Board of County Supervisors

- County Attorney

- Elections

- Executive Management

- Facilities & Fleet Management

- Finance

- Human Resources

- Human Rights

- Information Technology

- Management & Budget

Human Services accounts for $322 and 6.63% of the average residential tax bill in FY24.

- Area Agency on Aging

- Community Services

- Housing & Community Development

- Public Health

- Social Services

- Virginia Cooperative Extension

Public Safety accounts for $1,038 and 21.40% of the average residential tax bill in FY24.

- Adult Detention Center

- Circuit Court Clerk

- Circuit Court Judges

- Commonwealth's Attorney

- Criminal Justice Services

- Fire & Rescue

- General District Court

- Juvenile & Domestic Relations Court

- Juvenile Court Service Unit

- Magistrates

- Police

- Public Safety Communications

- Sheriff's Office

Schools accounted for $2,776 and 57.23% of the average residential tax bill in FY24. An additional $8 and 0.16% of the average residential tax bill in FY24 goes toward the Class Size Reduction Grant and 13th high school debt service.

Non-Departmental accounts for $58 and 1.19% of the average residential tax bill in FY24.

Debt Service accounts for $94 and 1.94% of the average residential tax bill in FY24.