FY2026 Budget

The Board of County Supervisors (BOCS) adopted the FY2026 Budget on April 22, 2025. It is available in its entirety or by sections below. This is the County's adopted budget beginning July 1, 2025, through June 30, 2026.

Understanding the Budget

The following sections of the FY2026 Budget aid in understanding the budget development process and explains the county's various revenue sources and expenditure budget. It also informs the community of capital infrastructure improvements and historical and statistical trends in the county.

- Introduction

- Budget Development Process

- Budget Summary

- Revenues

- Expenditures

- Compensation

- Agency Page Information

- Agreements, Donations, Grants & Memberships

- Capital Improvement Program PDF | Web Page

- Appendix

The Budget

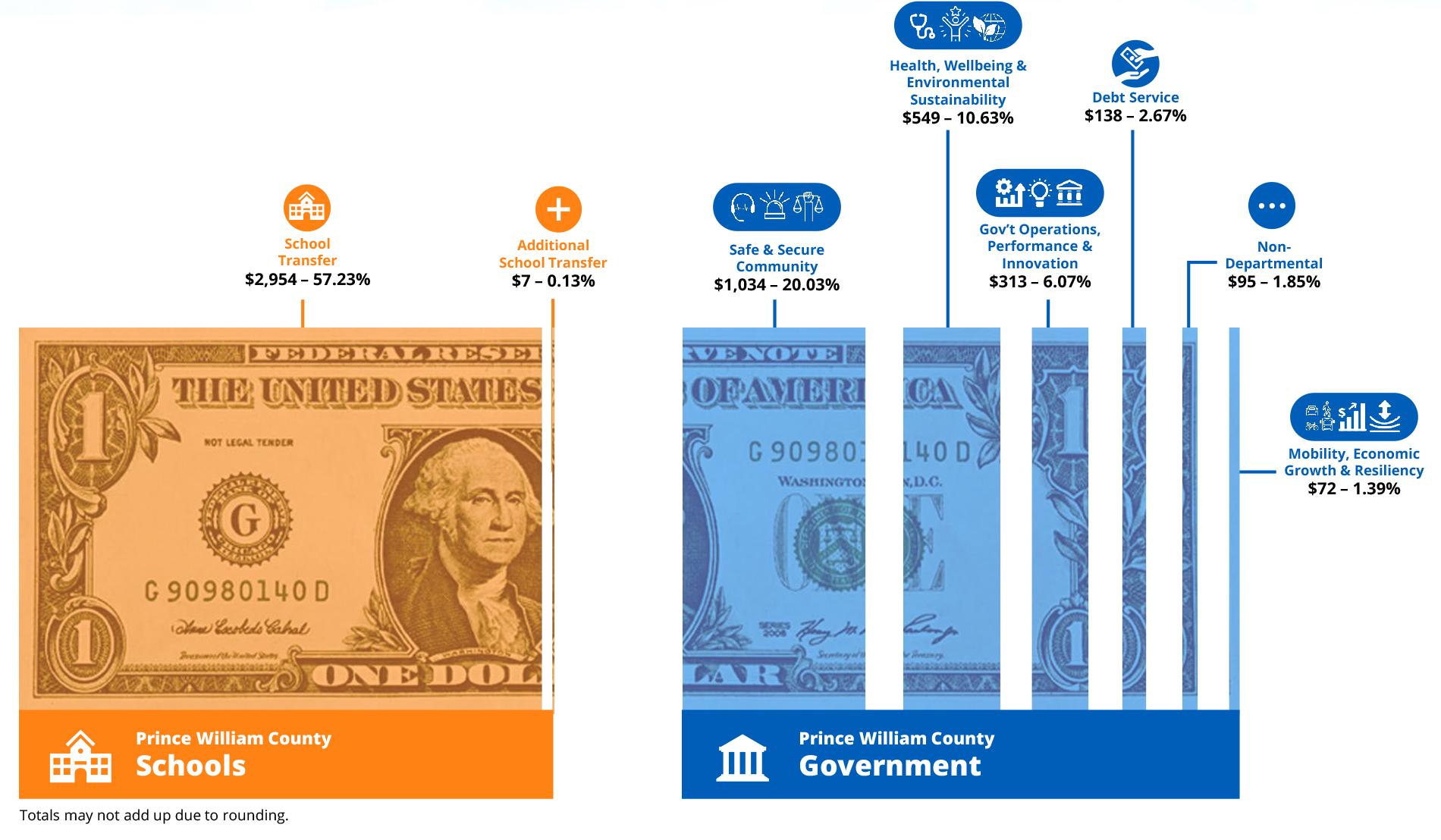

The FY2026 Budget is funded at a real estate tax rate of $0.906 per $100 of assessed value. The average residential tax bill based on that tax rate is $5,162. The following infographic shows the services that the average tax bill funds by functional areas. Information about the budget is available in sections below.

Government Operations, Performance & Innovation accounts for $313 and 6.07% of the average residential tax bill in FY26.

- Board of County Supervisors

- County Attorney

- Elections

- Executive Management

- Facilities & Fleet Management

- Finance

- Human Resources

- Human Rights

- Information Technology

- Management & Budget

- Procurement Services

Health, Wellbeing, & Environmental Sustainability accounts for $549 and 10.63% of the average residential tax bill in FY26.

- Area Agency on Aging

- Community Services

- Housing & Community Development

- Juvenile Court Service Unit

- Library

- Parks & Recreation

- Public Health

- Social Services

- Virginia Cooperative Extension

- Youth Services

Mobility, Economic Growth & Resiliency accounts for $72 and 1.39% of the average residential tax bill in FY26.

- Development Services

- Economic Development & Tourism

- Planning

- Public Works

- Transit Subsidy

- Transportation

Safe & Secure Community accounts for $1,034 and 20.03% of the average residential tax bill in FY26.

- Adult Detention Center

- Circuit Court Clerk

- Circuit Court Judges

- Commonwealth's Attorney

- Criminal Justice Services

- Fire & Rescue

- General District Court

- Juvenile & Domestic Relations Court

- Magistrates

- Police

- Public Safety Communications

- Sheriff's Office

Schools accounted for $2,954 and 57.23% of the average residential tax bill in FY26. An additional $7 and 0.13% of the average residential tax bill in FY26 goes toward the Class Size Reduction Grant and building debt of the Gainesville High School.

Non-Departmental accounts for $95 and 1.85% of the average residential tax bill in FY26.

Debt Service accounts for $138 and 2.67% of the average residential tax bill in FY26.